A Springtime Challenge for Homebuyers

Understanding the Impact of Soaring Rates on Homebuying Affordability and Demand

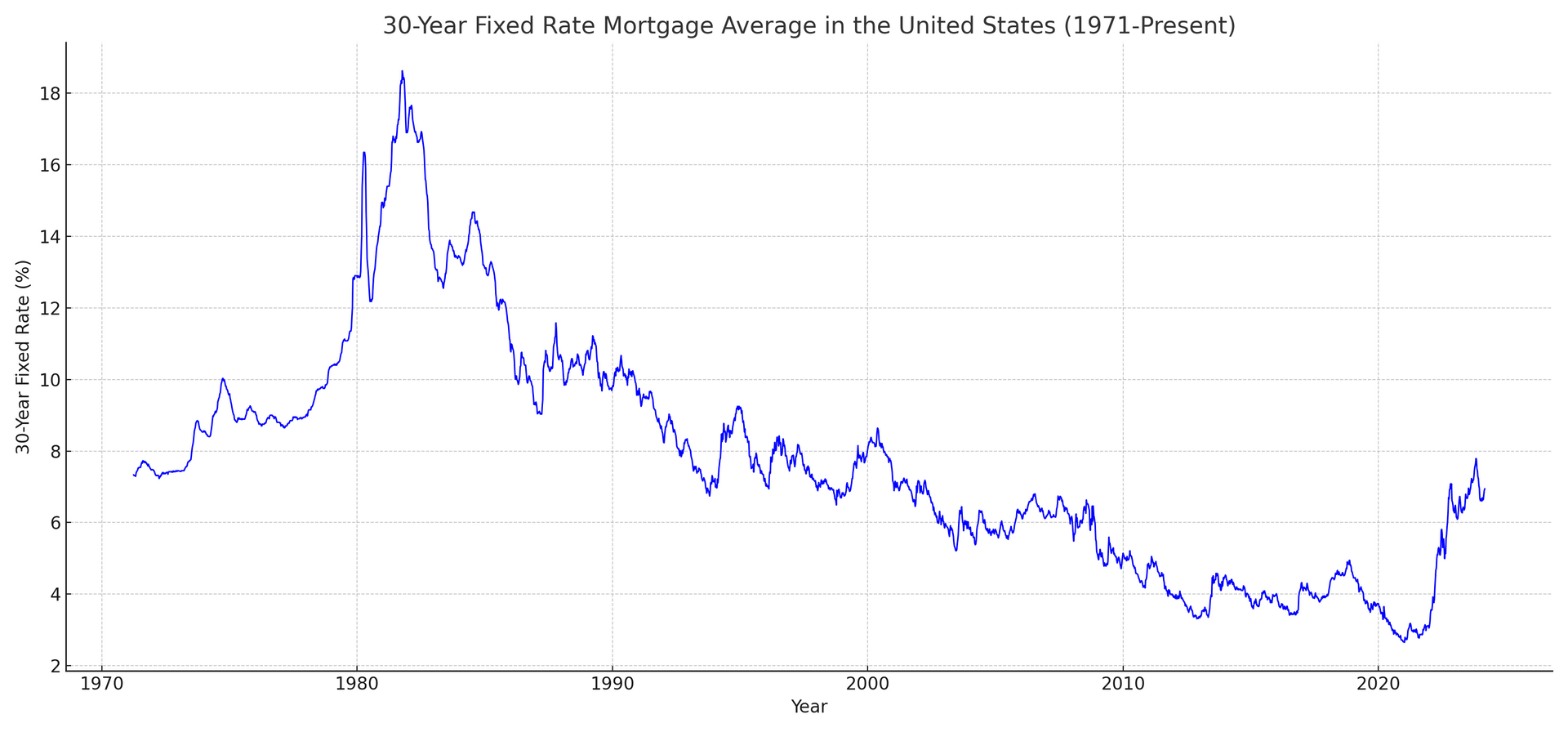

Mortgage rates have not come below 7% for the last two weeks. The average 30-year mortgage rate, according to Mortgage News Daily, had hit 7.16% twice over the past week before resting at 7.1% on Thursday, the highest average rate since November.

According to Freddie Mac, another gauge, tracking the average weekly rate for 30-year mortgages, suggested an increase to 6.94% from 6.90% the week before. This has represented four straight weeks of increase in rates according to this measure.

The slowdown in the rate of loans is going together with a rise in inflation rates higher than had been expected. Together with elevated house prices, these trends in scarce availability of houses have deterred many potential buyers.

In the words of Freddie Mac's chief economist, Sam Khater: "This week saw a continued rise in mortgage rates, hitting a two-month peak, and once again approaching the 7% mark. "The recent rate spike will add to the headwinds facing price-sensitive prospective homebuyers as we head into spring, historically the busiest season for home purchases.

It was the third straight week of declines in mortgage application volumes, according to the Mortgage Bankers Association (MBA), which reported a nearly 6% fall.

Purchase activities declined 7% week over week, while refinancing activities contracted by 5%. Activity year on year was a 12% fall in purchase activities and a 1% fall in refinancing.

"The recent uptick in rates has dampened activity, with a more significant drop observed last week among those seeking FHA and VA refinances," said Mike Fratantoni, chief economist of the MBA. These developments have compounded affordability challenges. The national median mortgage payment, according to MBA data, rose from $2,055 in December to $2,134 in January. This marks $170 added to the previous amount paid monthly at this time the year before, just over an 8% increase in costs for homebuyers. The S&P CoreLogic Case Shiller National Home Price Index had pointed out that home prices had risen by 5.5% in December on an annual basis.

The housing market in 2023 has gained solid prices in the face of high mortgage rates; it leaves an imbalance. Despite the high mortgage rates, demand does continue to outstrip supply, further adding to problems with affordability.

"The housing market is in a very weird place right now, with supply-constraints at least partly driven by homeowners who locked in very low mortgage rates and tax assessments years ago being reluctant to sell their homes in order to step up or down," said Bill Adams, senior economist at PNC Financial. High mortgage rates and high prices are squelching demand, painting a tough picture for homebuying affordability.

Clients who adhere to a debt relief program can expect an approximate saving of 57% before fees, or 22% inclusive of fees, spread over a period of 6 to 24 months. It's important to note that these estimates are based on debts that have been enrolled in our program. Please be aware that not all types of debts qualify for enrollment, and not all clients may complete our program due to factors like the ability to save sufficient funds. These estimates are based on prior results, which will inevitably vary depending on individual circumstances. While we aim to reduce your debts, we don't guarantee a specific reduction amount or percentage, nor do we promise that you'll be debt-free within a certain time frame. We don't take over consumer and/or business debt, and we don't offer tax, bankruptcy, accounting, legal, or credit repair services or advice. For information on the tax consequences of debt settlement, please consult a tax professional. For information on bankruptcy, consult with a bankruptcy attorney. Should you have further questions about our services, we encourage you to contact us.

© Copyright 2024 Clear Creditor Solutions All Rights Reserved.