Mastering Your Business Debt: The Key to Financial Health

Strategic Insights for Effective Debt Management and Financial Stability

Understanding the significance of managing long-term debts is crucial for any growing business. Keeping track of these debts is not just about maintaining your books; it's about strategic financial health and readiness for future opportunities. This is where a business debt schedule becomes an indispensable tool.

What is a Business Debt Schedule?

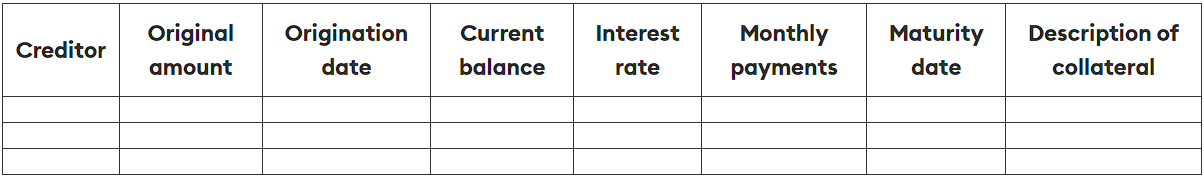

A business debt schedule is a comprehensive list that details all your long-term debts. This isn't about the everyday expenses but rather the significant obligations like loans, credit lines, and other long-term financial commitments. The schedule offers a comprehensive view, including crucial details like the original loan amount, current balance, interest rate, and monthly payments.

Creating Your Business Debt Schedule

To build a business debt schedule, start by collecting essential information about your debts. This includes the creditor's name, original loan amount, loan origination date, current balance, interest rate, payment details, and the status of each debt. Remember, transparency is key - the more detailed your schedule, the more control you have over your financial situation. An example of the type of layout you can use is below.

Benefits of a Business Debt Schedule

- Accurate Financial Records: It helps in maintaining precise financial records, crucial for effective forecasting and budgeting.

- Timely Payments: Regularly updating and reviewing the debt schedule ensures timely payments and avoids delinquencies.

- Debt Prioritization: It allows you to strategize which debts to pay off first, potentially saving on higher interest rates.

- Assessing Additional Debt Capacity: It provides a clear picture of your current debts, helping you to make informed decisions about taking on new loans.

- Meeting Lender Requirements: A comprehensive debt schedule is often required by lenders when applying for new loans, as it reflects your debt-service coverage ratio.

- Identifying Refinancing Opportunities: By having all your debts in one place, you can easily spot opportunities for debt consolidation or refinancing for better rates.

A business debt schedule is not just a financial tool; it's a roadmap to your business's financial stability and growth. By meticulously tracking and managing your debts, you position your business for success, ready for new opportunities and resilient against financial challenges.

Remember, a healthy business is not one without debt, but one that manages its debts wisely.